Welcome to Homeseed’s Mortgage Market Update, where we dive into the latest trends, insights, and changes shaping the dynamic landscape of the housing and lending industries.

Mortgage Rate Trends & Forecasts

- Mortgage rates are flat but volatile week-over-week after surging much higher the week prior.

- The pressure for higher rates was caused by a strong jobs report, more troubling inflation data, and a higher consumer spending.

- The odds for the first rate cut by the Fed’s July meeting has now fallen below 50%.

Consumer Price Index (CPI)

- The monthly report showed inflation was much hotter than expected in March, continuing a trend we’ve seen in recent months.

- Rising energy, automobile insurance, and shelter costs were the main contributors to the increase in inflation.

- Annual inflation still remains below the peaks in 2022, but stubbornly high inflation readings will likely delay the Fed’s timing for rate cuts this year.

Home Builder Sentiment

- The most recent Home Builder Sentiment report by NAHB showed that sentiment among builders remains in positive territory.

- Internal components of the report show that buyer traffic and current sales expectations ticked higher.

- Forward looking sales expectations have softened a bit due to higher rates as some buyers remain on the fence.

- MORTGAGE RATES FLAT – Rates are relatively unchanged week-over-week but the daily changes have been volatile.

https://www.mortgagenewsdaily.com/… - RATE CUTS DELAYED – The Fed Funds Rate could stay higher for longer if inflation persists.

https://www.morningstar.com/… - WHAT HOMEBUYERS WANT – A recent study shows that a vast majority of homebuyers are looking for a home with at least one home office.

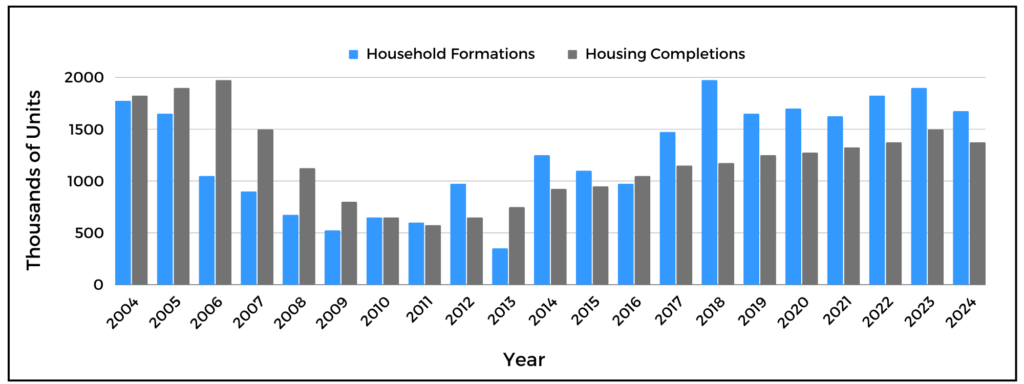

https://www.eyeonhousing.org/… - HOME PRICES KEEP CLIMBING – Higher rates are keeping a lid on housing supply and putting pressure on home price appreciation.

https://www.housingwire.com/…